It’s been another rollercoaster week for the film industry. Two major announcements with a wide range of implications are still being absorbed by anyone and everyone with an interest in this sector of the entertainment ecosphere.

On Monday, the long-awaited greenlight for New York City’s movie theaters to reopen was finally given by Governor Andrew Cuomo. Effective March 5, the city’s cinemas will be allowed to operate at 25 percent capacity seating, with no more than 50 people per auditorium. It’s one of the two biggest moviegoing markets in the country, one that will finally show signs of life after eleven months in shutdown mode.

The second development came Wednesday during an Investor Day presentation. Focusing largely on parent company Viacom’s rebranding and revitalization of CBS All Access into the Paramount+ streaming platform, another piece in the puzzle of theatrical windows was addressed: The studio will commit its releases to exhibition exclusively for 30 to 45 days before making them available on their streamer.

In between all of this, there are still valid questions about the concreteness of any plan that involves a return to a full-scale exhibition presence. Still, we continue to see relatively little movement on the part of studios when it comes to big release delays as they play the long game and wait out the end of this devastating winter.

Simultaneously, moviegoers are growing more confident about the potential of going back to theaters as vaccines become accessible throughout this year. According to a recent NRG survey, consumers have never been as optimistic about such a return during the pandemic as they are right now.

For more indication of the light at the end of the tunnel, Sony Pictures and Marvel Studios this week ignited the marketing engine for the recently titled Spider-Man: No Way Home — a film still dated for release this Christmas (after three other MCU movies), and one which has more-than-considerable potential to become the year’s biggest box office hit.

With that summary in mind, let’s break things down a little bit more.

New York City’s Cinemas to Reopen: What Does That Mean?

This is a significant step forward in the long process toward economic recovery for both theaters and studios. Despite the number of low-to-mid profile films that have skipped theaters for streaming releases during the pandemic so far, studios have by-and-large delayed, delayed, and delayed some more when it comes to their biggest potential moneymakers, tentpoles, and franchises.

Regal Cinemas itself cited the need for New York City and Los Angeles to come back online — with steady product — before they can deem their theaters to be in a position of operating at an acceptable level. That’s why, after a brief re-opening period early last fall, Regal turned their lights back off temporarily until such developments occurred.

It remains to be seen when Regal resumes operations even in a limited capacity following New York City’s announcement, particularly with Los Angeles still in a general state of flux as questions continue swirling as to when its own cinemas will be allowed to reopen. Regal made it clear that they’ll wait for the City of Angels with an official statement on February 25.

When it comes to the city itself, California Governor Gavin Newson hasn’t laid out a clear timeline or target date for L.A.’s movie houses to reopen, but Cinemark CEO Mark Zoradi prognosticated on February 26 that it could happen within the next two to four weeks. Still, nothing is confirmed right now.

Between the pair of them, New York City and Los Angeles account for up to 15 percent of the domestic grossing market from a box office standpoint, on average. Some films (such as arthouse and indie titles) skew higher. Others, such as four-quadrant blockbusters and family films, see their earnings more widely dispersed throughout North America’s urban and rural areas alike.

For half of that crucial equation to come back on the playing field, vaccine injections from Moderna and Pfizer’s available doses need to continue improving while Johnson & Johnson also progresses toward its own shipments. Temporary setbacks with distribution and production are being addressed as the United States has topped 68 million shots through February 25, a development that provides encouragement for the hearts of exhibition to start beating with a little more hope as 2021’s second quarter peaks around the corner.

Still, revitalization will not occur overnight just because New York City theaters will be open one week from now. Various films and theaters able to operate have shown in recent months that moviegoers are still seeking out the cinematic experience. However, there are still many people, especially in the largest urban areas, who are likely to play it safe a few more weeks (if not months) until the country approaches a higher degree of inoculation and, eventually, herd immunity against COVID-19… and until the big movies return.

We may see an uptick in box office earnings for many films when NYC turns the lights back on, but it’s wise to expect upward trends over a longer period of time rather than in an instant.

With two major studio releases, Raya and the Last Dragon (also debuting on Disney+ the same day) and Chaos Walking bowing nationwide on the same day as NYC’s restart, though, it’s clear that the next phase of the recovery is about to begin. They’ll be followed by titles like The Courier (March 19), Nobody (March 26), and Godzilla vs. Kong (March 31) before Easter — providing the most steady dose of high-profile content to hit movie theaters since before the pandemic. Mortal Kombat, not to be forgotten, will also open day-and-date on April 16.

This essentially allows a two-month period for not just the residents of The City That Never Sleeps to grow comfortable with moviegoing (among other outside-the-home activities) again, but for the corporate marketing engines of the industry to start booting back up if they like the results they see throughout winter’s end and spring’s beginning. Tangentially, the early weeks of NYC’s restart may also allow other crucial markets like Los Angeles and San Francisco to find their own timelines for re-opening before the middle of spring and early summer.

Speaking of early summer, that’s when the release schedule is currently positioned to pick up even more significantly with the likes of Black Widow (May 7 — which Disney is still committing to theaters), Free Guy (May 21), Spiral (May 21), Cruella (May 28), Fast 9 (May 28) and Infinite (May 28).

For now, at least.

If the past year has taught the industry anything, it’s that it’ll happen when it happens. More delays and potential hybrid releases can’t be ruled out, but the industry is expressing more cautious optimism than it has in many months. Even if that slate doesn’t hold and some (or all) are pushed back another couple of months, early-to-mid summer increasingly looks like a transition period that could help guide the way into a more robust second half of the year.

To repeat for the umpteenth time, whether or not those films meet their current release dates depends on the continued upward trends of vaccinations and declining virus cases — all while keeping an eye on its growing number of variants. But if China’s record-breaking Lunar New Year box office hauls taught us anything earlier this month, it’s that moviegoers will likely be ready when the appropriate time comes.

Paramount’s 30-to-45-Day Theatrical Windows: What Do They Mean?

Barely 48 hours after the widely heralded news about New York City, it was revealed that Paramount will commit their films to exhibition exclusively for anywhere between four and six weekends. After that, such highly anticipated releases like A Quiet Place Part II and Mission: Impossible 7 will be available to stream on Paramount+.

Realistically, this is much closer to a presumed common ground of shortened windows that should be expected in the long run.

Universal’s 17-day and 31-day (for $50 million-plus opening weekenders) agreements with AMC and Cinemark may or may not be open to some molding once the pandemic begins to subside, as may Warner Bros.’ 2021 experiment of day-and-date releases to HBO Max. Paramount, on the other hand, may have just moved much closer to the sweet spot for some of Hollywood’s most important box office players.

Granted, not all studios (Sony and Lionsgate, notably) have in-house streaming platforms available to them, and there will certainly be trends to watch for when it comes to premium-priced PVOD rentals versus full-on availability of a movie at no extra cost to existing subscribers of a given service.

For a slightly deeper dive into how the math of Paramount’s decision works more in favor of exhibitors than against, the original A Quiet Place earned 94 percent of its $188 million domestic total by the 45th day of its release three years ago (and 84 percent by day 30, for argument’s sake).

Even as an original film that broke out beyond expectations and enjoyed strong legs, it was ranking in the bottom tier of the top ten on a daily and weekend basis by that point in its run — leaving the top ten by day 57 and losing 76 percent of its theatrical footprint by day 64.

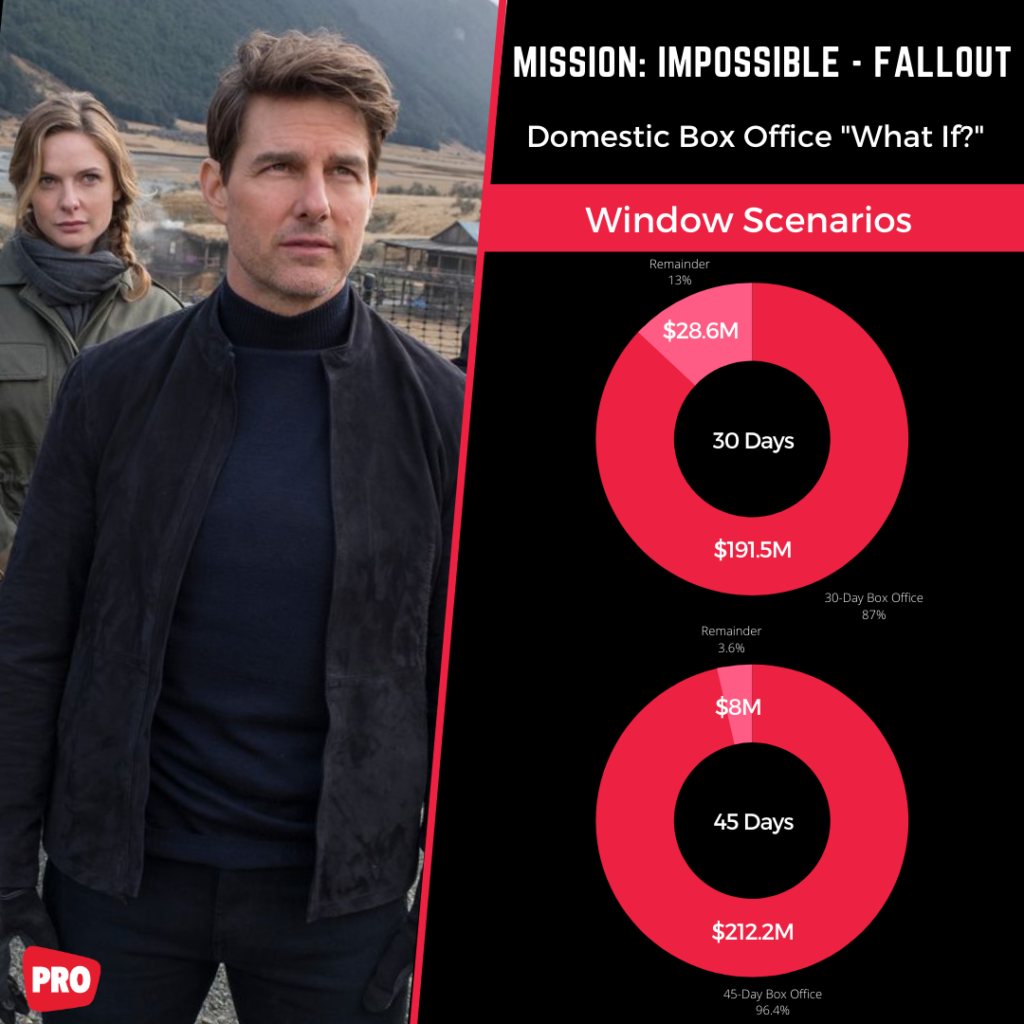

From the franchise perspective, the ratios drift even higher. Mission: Impossible – Fallout earned 96 percent of its final $220.2 million domestic box office by the 45th day of play (87 percent by day 30).

That franchise is notably leggier than most due to its older target audience, and it was still approaching the metaphorical end credits of its run. The sequel was out of the top 10 and absent from 80 percent of its maximum location count by day 57.

Yes, cinema owners defer a lower share of box office earnings as most films age in theaters, but these two examples point out why the concession may not be as detrimental as some perceive.

From a more theoretical standpoint, Paramount’s flexibility to hit streaming around that point can reduce marketing expenses for downstream at-home releases — in turn saving the studio money. That’s money which can be funneled into producing more content for theaters (and, yes, streaming as well).

While there is still no one-size-fits-all plan across all studios or theater owners, Paramount could ultimately end up providing a blueprint that allows for the most give-and-take between both parties.

Theaters may lose out on that higher profit share of a leggy, word-of-mouth-driven film after four, five, or six weekends, but we’re talking about small potatoes at that point compared to the bulk of earnings made in the first weeks. Plus, cinema owners would presumably still have the option of screening it (for those who simply would rather watch a cinematic movie in a real cinema, rather than at home).

In turn, even some portion of that 4-to-16 percent range in the post-30- or post-45-day windows in the above examples may still be in play. After all, there’s no guarantee every single prospective moviegoer will forfeit the big screen option due to streaming access.

Even more importantly, and again theoretically, screens may open up for movies or other special content that could be in a position to attract more customers than the seventh weekend of a movie that has already earned the lion’s share of its potential. This is a development many will be watching in the post-pandemic era, especially when it comes to opening the doors for streamers’ film content to play in theaters for limited engagements.

Content production is only going to increase by large margins as the world comes out of this pandemic, especially with so many avenues for distribution at the feet of studios now thanks to the coexistent event potential of cinemas and the episodic appeal of streaming. It’s ultimately up to the studios to put this strategy into effect, but with foresight-driven leadership and strategizing, the long-term benefits could outweigh the short-term sacrifices.

Domestic Market Update

Last month, we reported that January’s retail reporting period would close out between $55 million and $60 million domestically, ultimately finishing with an estimated at $57 million. While forecasting February to cap out near $40 million, the month now looks to end with roughly $50 million.

The slight upside over initial February forecasts can mostly be attributed to the sustained legs of films like The Croods: A New Age and The Marksman, sporadic re-openings in areas like Chicago and Seattle, softer-than-typical declines on Super Bowl weekend, and The Little Things‘ ability to haul the best R-rated opening weekend of the pandemic thus far.

Looking ahead, March should see significant improvement with the aforementioned release slate bulking up noticeably. Between Saturday, February 27 and Friday, April 2, the reporting period is currently tracking for a haul between $85 million and $95 million. If it lands on the high end of that range, the first quarter of 2021 would sneak over the $200 million threshold and finish off just 14 percent from Q4 2020 despite the holiday virus surge, lingering market closures throughout January, and a scant calendar of high profile movies.

Should Raya or another of the mainstream-appealing films in March beat expectations by even a small margin, there would be upside for a monthly total close to $100 million for only the third time during the pandemic. It could be challenging to reach the estimated $104 million 35-day reporting period of December 2020, but ever-evolving market conditions (New York City’s reemergence especially) certainly leave that scenario on the table.

While it may be unlikely to reach Q4 2020’s $233.4 million haul, the industry is at least now entering a phase where Q1 2021 is in a position to provide momentum heading into Q2 — when, for now, a lot more Hollywood product tentatively awaits.

Long Range Forecast & 2021’s Wide Release Calendar

| Release Date | Title | 3-Day (FSS) Opening Forecast Range | % Chg from Last Week | Domestic Total Forecast Range | % Chg from Last Week | Distributor |

| 3/5/2021 | Boogie | Focus Features | ||||

| 3/5/2021 | Chaos Walking | $2,000,000 – $7,000,000 | 10% | $6,000,000 – $25,000,000 | 14% | Lionsgate |

| 3/5/2021 | Raya and the Last Dragon | $7,000,000 – $15,000,000 | $30,000,000 – $60,000,000 | Walt Disney Pictures | ||

| 3/12/2021 | (no releases scheduled) | |||||

| 3/19/2021 | The Courier | $2,000,000 – $7,000,000 | 17% | $7,000,000 – $25,000,000 | 15% | Lionsgate |

| 3/19/2021 | Last Call | IFC Films | ||||

| 3/19/2021 | My Brother’s Keeper | Collide Distribution | ||||

| 3/26/2021 | Nobody | $5,000,000 – $10,000,000 | $10.000,000 – $30,000,000 | Universal Pictures | ||

| 3/31/2021 | Godzilla vs. Kong | $8,000,000 – $13,000,000 | 10% | $15.000,000 – $40,000,000 | 10% | Warner Bros. Pictures |

| 4/2/2021 | (no releases scheduled) | |||||

| 4/9/2021 | Voyagers | $2,000,000 – $7,000,000 | $5.000,000 – $20,000,000 | Lionsgate | ||

| 4/16/2021 | Fatherhood | Sony Pictures / Columbia | ||||

| 4/16/2021 | Mortal Kombat (2021) | $4,000,000 – $9,000,000 | 39% | $10,000,000 – $25,000,000 | 35% | Warner Bros. Pictures |

| 4/16/2021 | Untitled Universal Event Film II (2021) | Universal Pictures | ||||

| 4/23/2021 | (no releases scheduled) | |||||

| 4/30/2021 | (no releases scheduled) | |||||

| 5/7/2021 | Black Widow | Disney / Marvel Studios | ||||

| 5/14/2021 | Those Who Wish Me Dead | Warner Bros. Pictures | ||||

| 5/21/2021 | Final Account | Focus Features | ||||

| 5/21/2021 | Free Guy | Disney / 20th Century Studios | ||||

| 5/21/2021 | Spiral: From the Book of Saw | Lionsgate | ||||

| 5/28/2021 | Cruella | Walt Disney Pictures | ||||

| 5/28/2021 | F9 | Universal Pictures | ||||

| 5/28/2021 | Infinite | Paramount Pictures | ||||

| 6/4/2021 | The Conjuring: The Devil Made Me Do It | Warner Bros. / New Line | ||||

| 6/4/2021 | Samaritan | United Artists Releasing | ||||

| 6/4/2021 | Spirit Untamed | Universal Pictures | ||||

| 6/4/2021 | Vivo | Sony Pictures / Columbia | ||||

| 6/11/2021 | Peter Rabbit 2: The Runaway | Sony Pictures / Columbia | ||||

| 6/18/2021 | In the Heights | Warner Bros. Pictures | ||||

| 6/18/2021 | Luca | Disney / Pixar | ||||

| 6/25/2021 | Blue Bayou | Focus Features | ||||

| 6/25/2021 | Venom: Let There Be Carnage | Sony Pictures / Columbia | ||||

| 6/30/2021 | Zola | A24 | ||||

| 7/2/2021 | Minions: The Rise of Gru | Universal Pictures | ||||

| 7/2/2021 | Top Gun: Maverick | Paramount Pictures | ||||

| 7/9/2021 | The Forever Purge | Universal Pictures | ||||

| 7/9/2021 | Shang-Chi and the Legend of the Ten Rings | Disney / Marvel Studios | ||||

| 7/16/2021 | Cinderella (2021) | Sony Pictures / Columbia | ||||

| 7/16/2021 | The Night House | Disney / Searchlight Pictures | ||||

| 7/16/2021 | Space Jam: A New Legacy | Warner Bros. Pictures | ||||

| 7/23/2021 | The Tomorrow War | Paramount Pictures | ||||

| 7/23/2021 | Old | Universal Pictures | ||||

| 7/30/2021 | The Green Knight | A24 | ||||

| 7/30/2021 | Jungle Cruise | Walt Disney Pictures | ||||

| 8/6/2021 | Hotel Transylvania 4 | Sony Pictures / Columbia | ||||

| 8/6/2021 | The Suicide Squad | Warner Bros. Pictures | ||||

| 8/13/2021 | Bios | Universal Pictures | ||||

| 8/13/2021 | Deep Water | Disney / 20th Century Studios | ||||

| 8/13/2021 | Don’t Breathe Sequel | Sony Pictures / Columbia | ||||

| 8/13/2021 | Respect | MGM / United Artists Releasing | ||||

| 8/13/2021 | Untitled Russo Brothers Family Film | United Artists Releasing | ||||

| 8/13/2021 | Untitled Blumhouse Project II (2021) | Universal Pictures | ||||

| 8/20/2021 | The Hitman’s Bodyguard 2 | Lionsgate | ||||

| 8/20/2021 | The King’s Man | Disney / 20th Century Studios | ||||

| 8/20/2021 | Paw Patrol | Paramount Pictures | ||||

| 8/27/2021 | The Beatles: Get Back | Walt Disney Pictures | ||||

| 8/27/2021 | Candyman | Universal Pictures | ||||

| 9/3/2021 | Jackass | Paramount Pictures | ||||

| 9/3/2021 | Reminiscence | Warner Bros. Pictures | ||||

| 9/3/2021 | Untitled Resident Evil | Sony Pictures / Columbia | ||||

| 9/10/2021 | Malignant | Warner Bros. Pictures | ||||

| 9/17/2021 | The Boss Baby: Family Business | Universal Pictures | ||||

| 9/17/2021 | Death on the Nile | Disney / 20th Century Studios | ||||

| 9/17/2021 | Man from Toronto | Sony Pictures / Columbia | ||||

| 9/17/2021 | A Quiet Place Part II | Paramount Pictures | ||||

| 9/24/2021 | The Eyes of Tammy Faye | Disney / Searchlight Pictures | ||||

| 9/24/2021 | Dear Evan Hansen | Universal Pictures | ||||

| 9/24/2021 | The Many Saints of Newark | Warner Bros. Pictures | ||||

| 10/1/2021 | The Addams Family 2 | United Artists Releasing | ||||

| 10/1/2021 | Dune | Warner Bros. Pictures | ||||

| 10/8/2021 | No Time to Die | MGM | ||||

| 10/15/2021 | Halloween Kills | Universal Pictures | ||||

| 10/15/2021 | The Last Duel | Disney / 20th Century Studios | ||||

| 10/22/2021 | Last Night in Soho | Focus Features | ||||

| 10/22/2021 | Ron’s Gone Wrong | Disney / 20th Century Studios | ||||

| 10/22/2021 | Snake Eyes | Paramount Pictures | ||||

| 10/29/2021 | Antlers | Disney / Searchlight Pictures | ||||

| 11/5/2021 | Clifford the Big Red Dog | Paramount Pictures | ||||

| 11/5/2021 | Eternals | Disney / Marvel Studios | ||||

| 11/11/2021 | Ghostbusters: Afterlife | Sony Pictures / Columbia | ||||

| 11/19/2021 | King Richard | Warner Bros. Pictures | ||||

| 11/19/2021 | Mission: Impossible 7 | Paramount Pictures | ||||

| 11/24/2021 | Encanto | Walt Disney Pictures | ||||

| 12/3/2021 | Nightmare Alley (Limited) | Disney / Searchlight Pictures | ||||

| 12/10/2021 | American Underdog: The Kurt Warner Story | Lionsgate | ||||

| 12/10/2021 | Cyrano | United Artists Releasing | ||||

| 12/10/2021 | West Side Story (2020) | Disney / 20th Century Studios | ||||

| 12/17/2021 | Spider-Man: No Way Home | Sony / Columbia / Marvel Studios | ||||

| 12/17/2021 | Untitled Disney Live Action | Walt Disney Pictures | ||||

| 12/22/2021 | Untitled Matrix Sequel | Warner Bros. Pictures | ||||

| 12/22/2021 | Sing 2 | Universal Pictures | ||||

| 12/31/2021 | (no releases scheduled) |

As always, the news cycle is constantly evolving as the pandemic dictates. Projections are subject to breaking announcements at any moment.

For press inquiries, please contact Shawn Robbins

Follow Boxoffice PRO on Twitter

The post Long Range Box Office Forecast: What Do New York City’s March 5 Reopening and Paramount’s Shorter Windows Mean for the Industry? appeared first on Boxoffice.

from Boxoffice

0 comments:

Post a Comment