The global box office fell by 72 percent in a beleaguered 2020 for the movie theater industry, finishing the year with $12 billion in ticket sales according to the Motion Picture Association’s (MPA) annual THEME report.

Overseas box office was responsible for $9.8 billion in ticket sales, representing 81 percent of the overall global market. Much of that business came from the $6 billion earned by the Asia Pacific region, which hosted three of the world’s top 5 box office markets in 2020: China (#1, $3 billion), Japan (#3, $1.3 billion), and South Korea (#5, $0.4 billion). The Europe Middle East & Africa (EMEA) region suffered a 61 percent drop to $3.3. billion, while Latin America suffered the biggest losses during the pandemic with an 82 percent drop to $0.5 billion.

The North American market, comprised by the United States and Canada, experienced an 80 percent decline in box office ($2.2 billion), translating to a total of 240 million admissions in 2020. The number of cinema admissions in the United States had previously fluctuated from 1.24 to 1.36 billion since 2011. According to the MPA, the typical moviegoer bought 1.5 tickets in 2020, down from 4.6 the previous year.

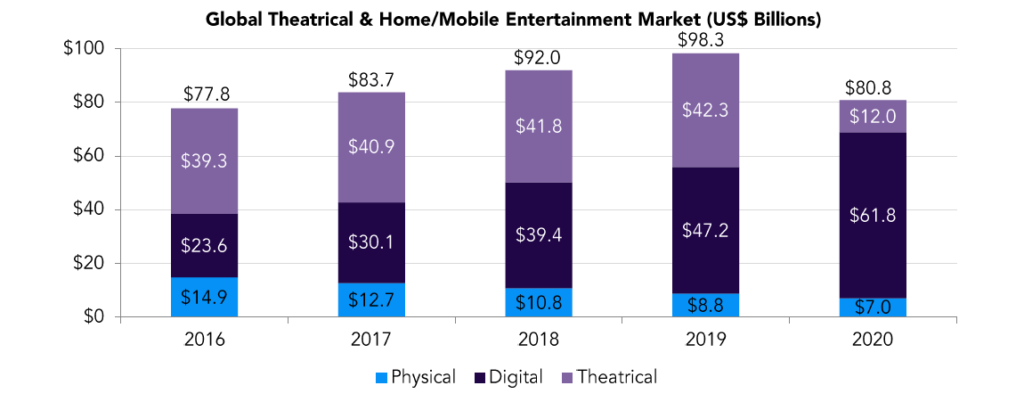

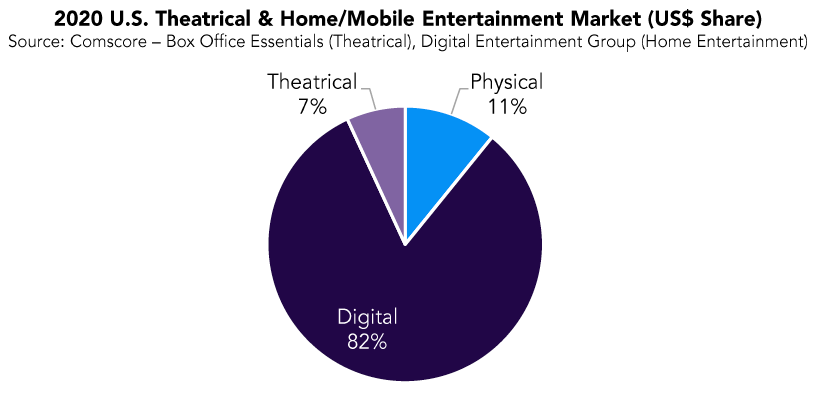

Less than half of the U.S./Canada population attended a cinema in 2020, a year where digital home entertainment accounted for 82 percent of the entire entertainment sector. Streaming revenues in the United States have more than doubled over the last four years––from $11.4 billion in 2016 to $26.5 billion in 2020––while physical media has shrunk by more than half during the same term––from $8 billion in 2016 to $3.5 billion in 2020. Theatrical revenues had consistently surpassed $11 billion since 2016, until falling to $2.2. billion in 2020 due to the onset of the Covid-19 pandemic.

2020 Top 20 Global Box Office markets – All Films (US$ Billions)

Source: Omdia, local sources

| Rank | Market | Box Office (Billions) |

| 1. | China | $3.0 |

| 2. | North America (U.S. & Canada) | $2.2 |

| 3. | Japan | $1.3 |

| 4. | France | $0.5 |

| 5. | South Korea | $0.4 |

| 6. | U.K. | $0.4 |

| 7. | India | $0.4 |

| 8. | Germany | $0.4 |

| 9. | Russia | $0.3 |

| 10. | Australia | $0.3 |

| 11. | Italy | $0.2 |

| 12. | Spain | $0.2 |

| 13. | Netherlands | $0.2 |

| 14. | Mexico | $0.2 |

| 15. | Taiwan | $0.1 |

| 16. | Brazil | $0.1 |

| 17. | Indonesia | $0.1 |

| 18. | Denmark | $0.1 |

| 19. | UAE | $0.1 |

| 20. | Poland | $0.1 |

The pandemic upended the usual revenue driven by theatrical and helped spur a dramatic rise in home entertainment earnings as audiences stayed home. Home Entertainment brought in a total of $68.8 billion worldwide in 2020, driven almost entirely by digital––with physical media representing only $7 billion of that figure. Combined, theatrical and home entertainment earned a cumulative total of $80.8 billion in the year, down 18 percent from 2019’s $98.3 billion.

Subscription-based services within the digital home entertainment category experienced a particular upswing in 2020, a reflection of new platforms introduced by major media conglomerates. Subscription Video on Demand (SVOD) was up by 35 percent in 2020, earning $21.2 billion in the year––nearly three times the $7.8 billion SVOD brought in 2016. Transactional digital home entertainment, however, shrank by 2 percent in 2020 to $8.8 billion––down from $11.6 billion in 2016.

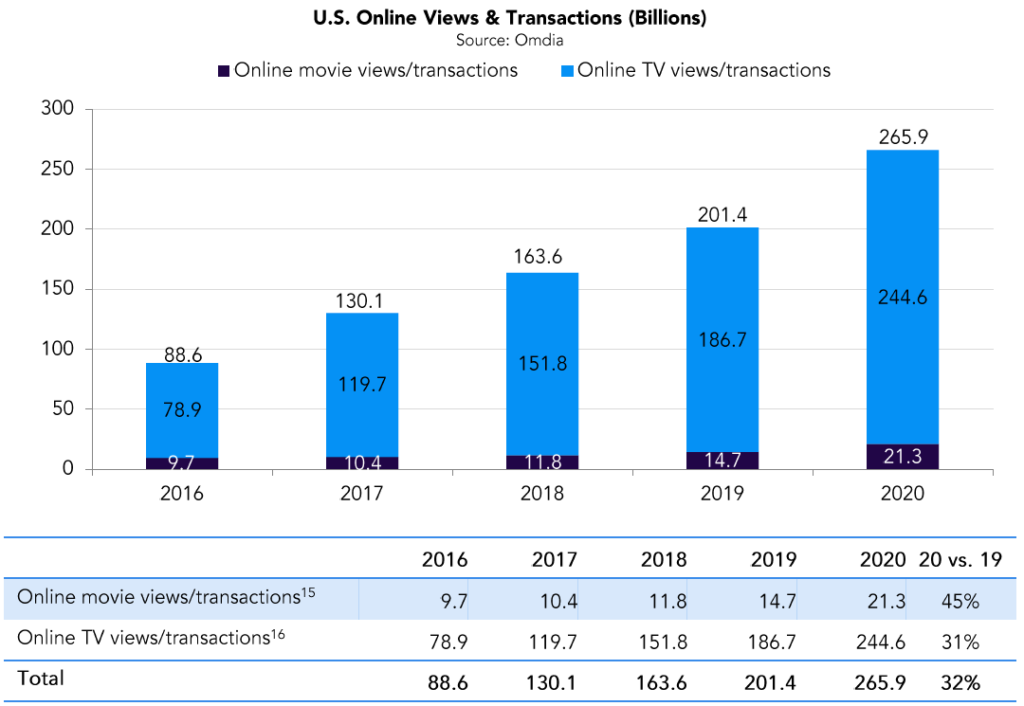

The growth of digital home entertainment has been significantly more disruptive for linear television than it has for the theatrical industry. Television content represents 92 percent of the overall online views and transactions in the United States. Although it represents a minority of digital transactions and viewership, streaming movies at home has seen a relative rise in popularity in recent years. Online movie views and transactions in the United States have more than doubled since 2016, and increased by 45 percent over the prior year in 2020.

Seven of the top ten streamed movies in the United States in 2020 were released in 2019 or before––including the top three titles of the year. Notably, eight of the top ten most-streamed movies in 2020 were children’s titles. The data reveals that despite an increased adoption and engagement in digital home entertainment platforms because of the Covid-19 pandemic, the bulk of home viewership remains centered around serial television content and library catalogue titles at this time.

Top 10 Streaming Films in the U.S. in 2020

Source: Nielsen

| Rank | Title | SVOD Provider | Minutes Streamed (Nearest Millions) |

| 1. | Frozen II (2019) | Disney+ | 14,924 |

| 2. | Moana (2016) | Disney+ | 10,507 |

| 3. | The Secret Life of Pets 2 (2019) | Netflix | 9,123 |

| 4. | Onward (2020) | Disney+ | 8,367 |

| 5. | Dr. Seuss’ The Grinch (2018) | Netflix | 6,180 |

| 6. | Hamilton (2020) | Disney+ | 6,132 |

| 7. | Spenser Confidential (2020) | Netflix | 5,374 |

| 8. | Aladdin (2019) | Disney+ | 5,172 |

| 9.. | Toy Story 4 (2019) | Disney+ | 4,416 |

| 10. | Zootopia (2016) | Disney+ | 4,400 |

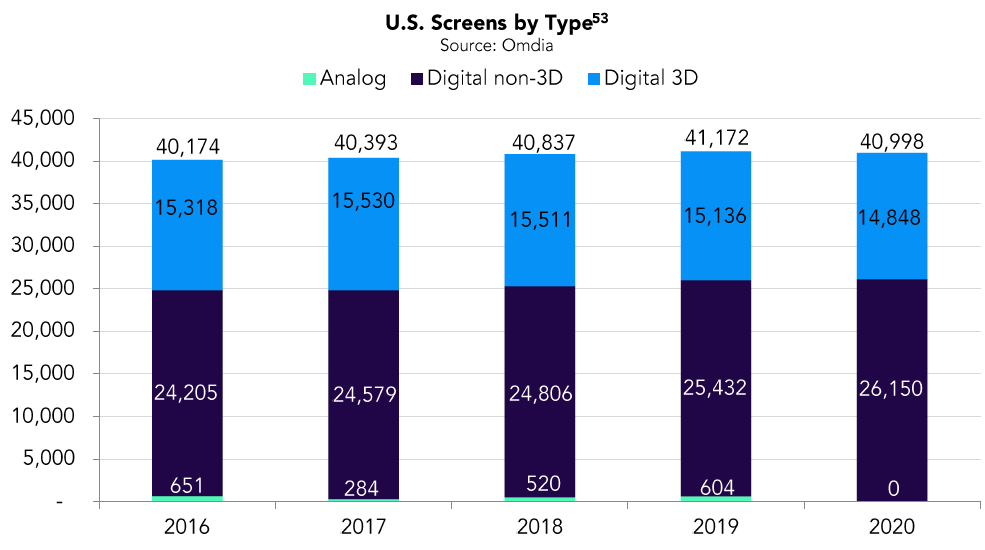

Despite the disruption caused by the pandemic, the number of cinema screens around the world increased by 6 percent in 2020 to a total of 207,650 screens. Asia Pacific accounts for nearly half of the world’s cinema screens with 103,603, followed by EMEA with 44,902, North America (U.S. & Canada) with 44,111, and Latin America with 15,034.

The number of cinema screens in North America increased by one percent in 2020 and has risen by 3 percent since 2016 despite the increasing popularity of digital home entertainment platforms. In the United States specifically, the number of screens decreased by 0.4 percent, from 41,172 to 40,998, but was nevertheless higher than the national screen counts of every year dating back to 2016.

The post Global Box Office Down 72%, Digital Leads Home Entertainment in 2020 appeared first on Boxoffice.

from Boxoffice

0 comments:

Post a Comment