A global pandemic plunged the global exhibition business into an existential crisis. Our look back on 10 pivotal moments in a historic year.

The Shutdown

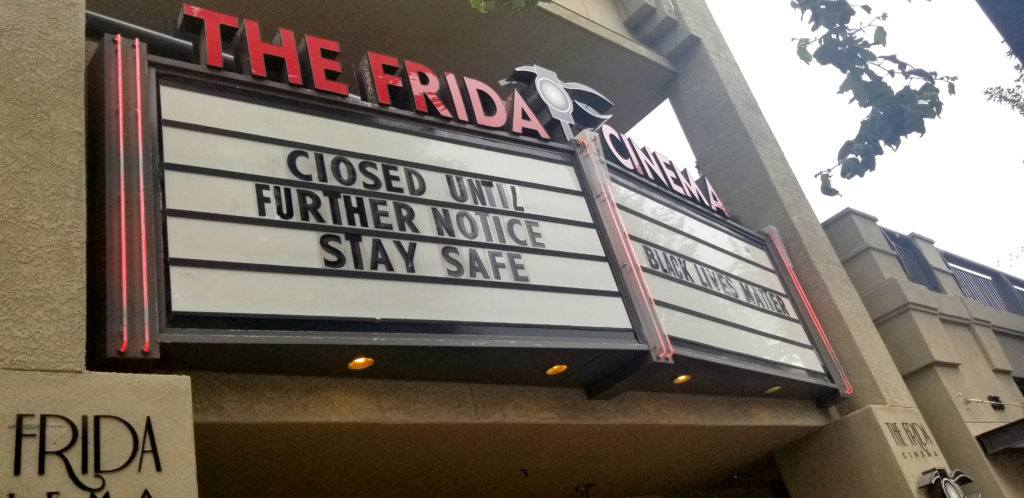

March

Sony’s Bad Boys for Life hit screens in North America on January 17, finishing its opening weekend at the box office with a successful $62.5 million. The first blockbuster of the year signaled a positive start for the industry; while analysts expected a dip in box office sales in 2020, there was widespread expectation the market would hit $11 billion for the sixth consecutive year. A day after the film’s opening weekend, January 20, the United States officially announced its first positive case of Covid-19.

There was no model by which to adequately gauge the potential impact of the virus on the cinema industry. Movie theaters had weathered epidemics before, most recently in 2009 with H1N1, commonly known as the Swine Flu, and even the direst of forecasts failed to predict the crisis that would soon unfold. Within days of the first confirmed infection in the U.S., the Chinese film industry took the drastic step of closing all its cinemas ahead of its Lunar New Year celebration––one of the busiest moviegoing periods of the year.

As the number of cases started to grow, businesses around the world began to feel the economic impact of the virus. On March 11, the National Association of Theatre Owners canceled its annual convention, CinemaCon, hours after it had come to light that actors Tom Hanks and Rita Wilson had contracted the virus while on set in Australia. By the following week, every major circuit in the North American market voluntarily closed, citing the public health risk of the pandemic. While some cinemas in the United States reopened as early as May, most major circuits remained closed until late August––after five months of working with health groups and local authorities to determine reopening guidelines.

The Release Date Shuffle

March

On March 4, MGM/UA’s James Bond adventure No Time to Die became the first title to forgo its scheduled release date, moving its April release to November. Universal followed suit days later by announcing it was delaying the Fast and Furious sequel F9 by a year to spring 2021. Those early shifts in the schedule set the stage for a wildly unstable (and unpredictable) release calendar in 2020. One by one, every major studio rushed to clear its second-quarter theatrical slate, as it became clear the crisis would extend into the summer.

July 17 was tentatively set as the date to kick off the summer movie season with Christopher Nolan’s Tenet, followed by Disney’s live-action Mulan a week later. Things didn’t go according to plan. Warner Bros. moved Tenet to July 31, then August 12, before finally settling on a staggered global release launching on August 26. The film eventually hit theaters in the United States on September 3.

For all the headaches caused by Tenet’s delay, exhibitors were grateful the film at least kept its commitment for a 2020 theatrical release. The same couldn’t be said about Mulan, which was taken off the release calendar in favor of a PVOD debut on Disney Plus. After earning $4.3 billion at the domestic box office in 2019, Disney pulled all its major titles from release in 2020. While most of those films were rescheduled for 2021, others, like Pixar’s Soul, were sent straight to streaming.

An unstable release calendar has since become a hallmark of the Covid-19 era, with release delays and cancellations occurring well into 2021.

© 2020 DreamWorks Animation LLC. All Ri

The Most Important Film of 2020: Trolls: World Tour

April

Universal’s decision to move Trolls: World Tour to streaming as a PVOD rental instead of shelving it for theatrical release received little comment from exhibitors in the early days of the pandemic. Several titles whose runs had been interrupted by the closures––including releases from Disney, Sony, and Universal––had already premiered on home entertainment platforms earlier than usual, an understandable exception to traditional exclusivity practices.

Trolls: World Tour wasn’t expected to be a major blockbuster in theaters, but the film was able to seize a unique moment in the market just as the United States entered what was essentially a national lockdown. The film’s success became a turning point for the industry when NBCUniversal CEO Jeff Shell told The Wall Street Journal that Universal planned to replicate the model’s success with its theatrical slate moving forward. The news was an unpleasant surprise to leading exhibitors, their circuits closed indefinitely, leading AMC Theatres to renounce the studio and vow not to program its titles moving forward.

The tensions were smoothed over by the summer, as Universal signed deals with top cinema chains granting their titles a shorter exclusivity window in theaters. Universal’s decision to send Trolls: World Tour to PVOD would act as a catalyst for a slew of changes instituted across the industry in the months to come.

The Dynamic Window

July

If Universal’s PVOD launch of Trolls: World Tour was the first step in shrinking the theatrical window, the studio took another leap toward that goal when it announced a groundbreaking agreement with AMC Theatres to shorten that window beyond the duration of the Covid-19 pandemic. After initially vowing not to book any Universal titles that would break the exclusivity, AMC went on to negotiate with the studio on a deal that shortened theatrical exclusivity to either 17 or 30 days, depending on the title. Crucially, AMC received a commitment from Universal to receive an undisclosed portion of digital rental revenues in exchange for being the first major chain to sign on to the proposal.

Signed in July, the AMC-Universal deal sent shockwaves across the industry. It signaled a shift from pandemic-specific measures around a handful of titles to a long-standing change in the economics of theatrical distribution. Nevertheless, the model was unlikely to work without additional circuits on board. It took nearly four months for that to occur, with Cinemark––the third largest exhibitor in North America––joining the deal and coining the term “Dynamic Window.” Cineplex, Canada’s largest circuit, struck its own agreement days after Cinemark.

Universal’s “Dynamic Window” establishes a 17-day minimum exclusivity for its titles at cinemas, after which they become available for digital rental at home. For select titles, that exclusivity period is extended to 30 days. It stands apart from similar moves made by competing studios by being the only model that has openly engaged cinemas (albeit limited to major circuits) in collaborating on an agreement. What theatrical exclusivity will look like once the market recovers is still up in the air, especially as the pandemic drags on into 2021, but the Dynamic Window model remains the only one to have gained significant traction with exhibitors.

CinemaSafe

August

As soon as cinemas went dark in March, the industry’s focus turned to reopening. A crucial part of that step was developing and instituting an industry-wide set of guidelines and best practices to mitigate the spread of Covid-19 in cinemas.

That effort culminated in August with the launch of CinemaSafe, a NATO-led initiative to establish a voluntary set of protocols based on World Health Organization, Centers for Disease Control, and Occupational Safety and Health Administration, in consultation with leading epidemiologists.

More than 370 companies, representing over 33,000 screens in North America, signed up for the program at launch. The CinemaSafe protocols include provisions for mask enforcement inside auditoriums, social distancing, reduced capacity, air filtration, modified concessions sales, mobile ticketing, and enhanced cleaning and disinfection measures for employees. The CinemaSafe logo became a fixture of pandemic-era moviegoing, informing and easing the first wave of moviegoers returning to theaters.

Tenet Opens––and Underwhelms

September

Christopher Nolan was among the exhibition industry’s most vocal supporters as the global health crisis took hold. It was therefore fitting that his latest film, Tenet, emerged as the frontrunner to signal a return to cinemas following the spring and early summer closures. A series of delays moved the title’s July 17 release date to a Labor Day weekend debut in the United States. The expectation was that the film would spur a gradual return to movie theaters, with tentpole titles to be released monthly to account for capacity restrictions.

Tenet’s box office performance did the opposite. Rather than encouraging studios to adapt to the demands of a pandemic-stricken market, it instead inspired an additional wave of delays and cancellations through the end of the year.

Tenet’s box office performance was unfairly maligned: A $363 million global haul is hardly disappointing, especially during a global pandemic. The film’s tepid run in North America, however, where it was never able to reach screens in either L.A. or New York City, the country’s top two cities for box office potential, ended with a $57.9 million take––setting an underwhelming benchmark for the domestic market. Ultimately, the title suffered from the weight of unrealistic expectations: the absurd notion that a baroque action-thriller could single-handedly initiate the revival of moviegoing in the middle of a pandemic. Tenet might not have saved cinemas, but it did offer a crucial financial lifeline––and is notable for being the only studio tentpole released during the pandemic to adhere to the preexisting theatrical exclusivity timeline.

Disney Goes Digital

September

Disney’s live-action version of Mulan (2020) was originally scheduled to hit screens in the United States on March 27. The title came with lofty expectations for the studio; shot in China, it had blockbuster potential in the top two global markets. Disney was forced to move the title to late July after the coronavirus shuttered cinemas across the U.S. and China.

Intended to open a week following Warner Bros.’ release of Christopher Nolan’s Tenet, Disney’s Mulan was seen as the more commercially viable of the two titles. The plan kept its shape when both titles were rescheduled for August but was suddenly scrapped in late July, when both Tenet and Mulan were removed from the schedule with little explanation. While Tenet eventually settled on a Labor Day release, Disney CEO Bob Chapek surprised investors during an early August earnings call by announcing that Mulan would skip theaters entirely and go straight to streaming on Disney Plus as a $29.99 digital rental.

Mulan’s move to PVOD marked a significant shift in Disney’s approach to theatrical distribution. The studio kept a steady supply of rereleases from its vault through the end of 2020, while also releasing titles from 20th Century Studios like The New Mutants and The Empty Man. Its high-profile titles, however, were either pushed to 2021 or, as was the case with Pixar’s Soul, skipped theaters to instead prioritize a streaming debut on Disney Plus.

The studio offered little more than a handful of platitudes on the “theatrical experience” during a four-hour-plus Investor Day presentation largely focused on diverting its production resources to supply content for Disney Plus. Crucially, however, the studio didn’t outright commit to an overarching policy on its upcoming tentpole titles in 2021––leaving all distribution options on the table amid an uncertain recovery time frame from the Covd-19 crisis.

Cineworld Scales Back

October

U.K.-based Cineworld entered 2020 on track to become the largest exhibition company in North America and the world through its announced acquisition of Canada’s Cineplex. News of the deal came only two years after the company announced its acquisition of Regal, the second largest circuit in the United States, and would have culminated with a presence of over 10,000 screens in the U.S. and Canada. Industry observers expected the deal to close early in the second quarter of 2020, perhaps even as early as CinemaCon––originally scheduled in late April. By year’s end, however, not only was the Cineplex deal off the table, but the vast majority of Cineworld and Regal locations were voluntarily closed until further notice.

Cineworld’s scaling back began in June, with the dissolution of the Cineplex acquisition, a move that set off a legal dispute between the two chains. Cineworld’s attention was simultaneously drawn to the reopening effort, with CEO Mooky Greidinger being among the loudest voices asking for clarity on reopening guidelines from government officials. That reopening effort was paused in October, following MGM/UA’s decision to further push the release of No Time to Die to 2021. At the time, the lack of a concrete reopening plan in important markets like New York and L.A., along with the instability in the theatrical release schedule, led the circuit to again shut down most of its locations in the U.K. and U.S. until further notice.

Cineworld and Regal locations were still closed as 2021 got under way. Perhaps most notably, Cineworld is the only major circuit with a leading U.S. presence to have not committed to terms with studios that have announced a reduced theatrical exclusivity window.

Warner Bros. Shatters the Window

December

The goodwill that Warner Bros. earned from exhibitors in its commitment to release Christopher Nolan’s Tenet was tested when the studio decided to release Wonder Woman 1984 simultaneously for home streaming on Christmas Day. In regular circumstances, the move would have been met with strong opposition from the exhibition community––but in this specific case, with this specific studio, the decision was met with muted understanding. Cinemas had suffered from a dearth of high-profile titles since Tenet’sSeptember release; Wonder Woman 1984 would hit screens desperate for content at a critical time. As the studio had already suffered a significant financial loss on Tenet, few could blame Warner for hedging its losses on the superhero sequel.

Whatever goodwill was left after that, however, was gone once WarnerMedia CEO Jason Kilar dropped a bombshell announcement: Warner Bros. would release its entire 17-film slate day-and-date on its streaming service, HBO Max, at no additional cost to subscribers throughout 2021. The model treated cinemas as a secondary distribution channel, their traditional exclusivity period pushed to a full month after a film’s streaming debut.

The fallout was swift. Filmmakers Christopher Nolan and Denis Villeneuve excoriated the decision publicly. “There is absolutely no love for cinema, nor for the audience here,” Villeneuve told Variety. In unilaterally breaking theatrical exclusivity, Warner Bros. found itself in a unique position: facing the ire of dismayed exhibitors while simultaneously being the only major studio to commit to a theatrical release calendar for all its major titles.

Save Your Cinema

December

As weeks turned into months, it became increasingly evident that movie theaters around the world were facing an existential crisis. Several key foreign markets, whose countries had done a better job managing the pandemic, successfully leveraged local films to take the place of Hollywood titles in welcoming audiences back to the cinema. The United States, however, had no such advantage. Contending with a barren release schedule, some exhibitors voluntarily re-closed some or all of their locations––the cost of staying open incurring greater losses than going dark. Come December, the industry was nearing irrevocable damage. Without government support, NATO president and CEO John Fithian estimated that as many as two-thirds of the movie theaters in the United States could go out of business.

NATO’s role in the pandemic was concentrated on two principal projects: the launch of CinemaSafe in September and an ongoing effort to secure government aid for movie theaters. The public-facing side of the campaign, Save Your Cinema, coordinated over 365,000 letters of support to all 535 members of Congress. The effort culminated with the inclusion of small and mid-size movie theaters in the larger Save Our Stages Act, giving eligible theaters a slice of $15 billion in government funding dedicated to event venues. The bill’s passage in the waning days of 2020 provided a crucial economic lifeline for cinemas, as they entered an uncertain 2021.

The post The Ten Most Important Moments for Domestic Exhibition in 2020 appeared first on Boxoffice.

from Boxoffice

0 comments:

Post a Comment